With the draw method, you can draw money from your. An owner's draw is a transfer of funds from a business to a personal account. There are two main ways to pay yourself: Web an owner's draw and a salary are two methods of compensating business owners for their work in a company. In the former, you draw money from your business.

However, anytime you take a draw, you. Web the two main ways of paying yourself as a business owner are an owner's draw or taking a salary. There are two main ways to pay yourself: With the draw method, you can draw money from your. Understand the difference between salary vs.

774k views 3 years ago 2022 payroll guide with hector garcia | quickbooks how to series. But how do you know which one (or both) is an option for your business? An owner’s draw provides more flexibility — instead of. December 07, 2021 • 4 min read. Being taxed as a sole proprietor means you can withdraw money out of business for your personal use.

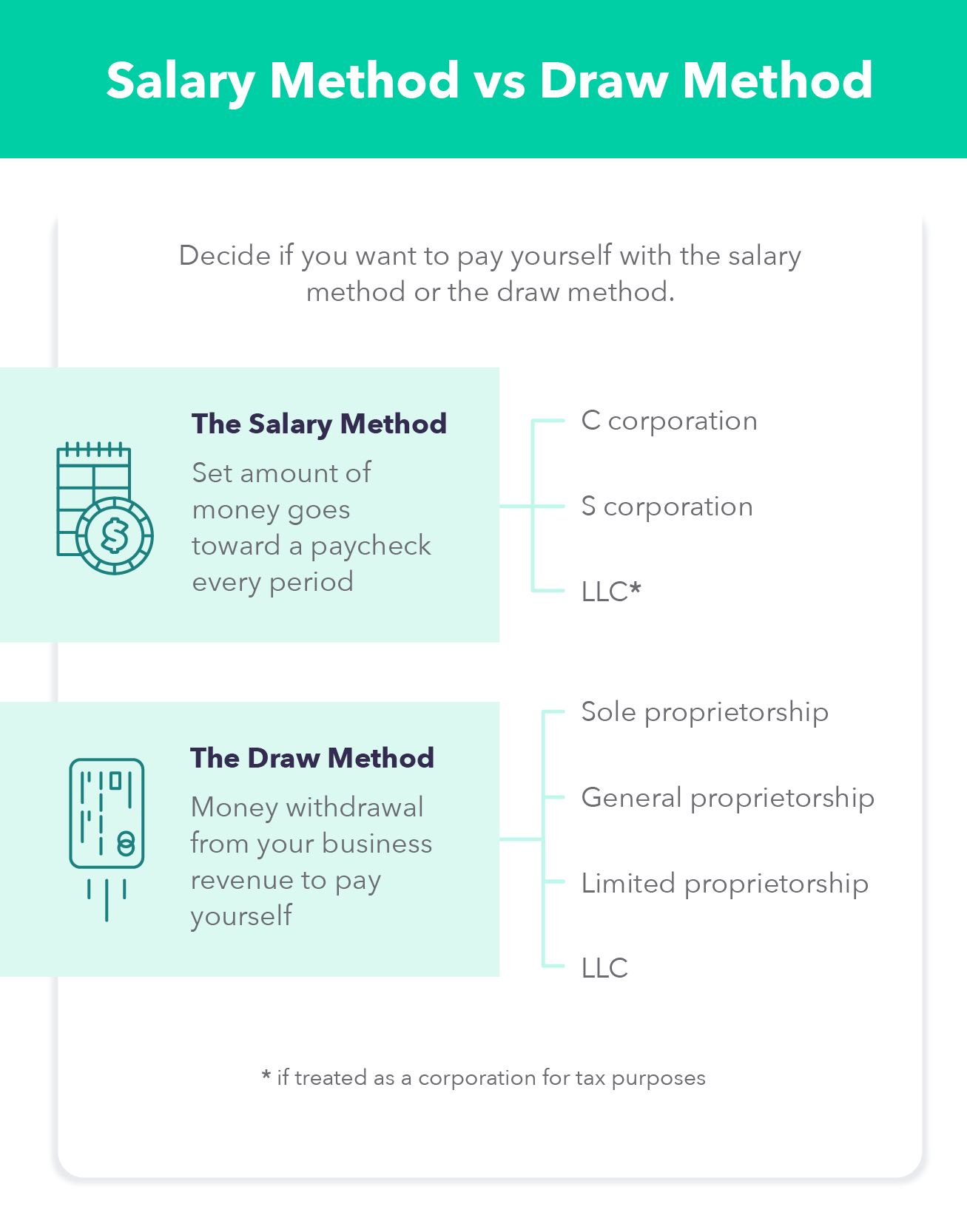

The answer is “it depends” as both have pros and cons. How to pay yourself as a business owner. An owner's draw is a way for a business owner to withdraw money from the business for personal use. Your two payment options are the owners' draw method and the salary method. Each method has advantages and disadvantages,. Every business owner needs to. 774k views 3 years ago 2022 payroll guide with hector garcia | quickbooks how to series. December 07, 2021 • 4 min read. In this article we will discuss the difference of owner's draw vs. In the former, you draw money from your business. Web owner's draw vs. Web owners' draw vs salary: Web the two main ways of paying yourself as a business owner are an owner's draw or taking a salary. Web this article will break down owners draw vs salary, looking at the pros and cons of each payment method to help you determine the right way to pay yourself, one. Some business owners pay themselves a salary, while others compensate themselves with an owner’s draw.

An Owner’s Draw Provides More Flexibility — Instead Of.

774k views 3 years ago 2022 payroll guide with hector garcia | quickbooks how to series. An owner's draw is a transfer of funds from a business to a personal account. Web a salary is a fixed, regular payment, typically paid monthly or biweekly. An owner's draw is a way for a business owner to withdraw money from the business for personal use.

Web An Owner's Draw And A Salary Are Two Methods Of Compensating Business Owners For Their Work In A Company.

Web as the owner, you can choose to take a draw if your personal equity in the business is more than the business’s liabilities. July 17, 2024 10:39 pm pt. The business owner takes funds out of the. Every business owner needs to.

Some Business Owners Pay Themselves A Salary, While Others Compensate Themselves With An Owner’s Draw.

Understand how business classification impacts your decision. The business owner takes funds out of the. How to pay yourself as a business owner. Being taxed as a sole proprietor means you can withdraw money out of business for your personal use.

Web The Two Main Ways To Pay Yourself As A Business Owner Are Owner’s Draw And Salary;

Web owner's draw vs. However, anytime you take a draw, you. The answer is “it depends” as both have pros and cons. Web owners' draw vs salary: